Advantages of TopBottomEA:

TopBottomEA boasts several advantages that make it a lucrative choice for traders:

- Support for Small Capital: TopBottomEA is the first EA designed to accommodate small capital investments, making it accessible to a wider range of traders.

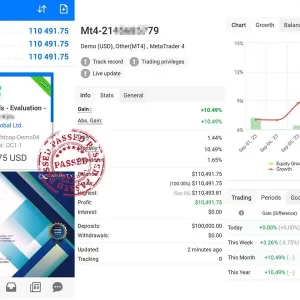

- Proven Track Record: With over 4 years in the market, TopBottomEA has established itself as a reliable option for traders, offering stability and consistency.

- Volatility Adaptive Mechanism: This EA operates on a volatility adaptive mechanism, ensuring adaptability to changing market conditions for optimal performance.

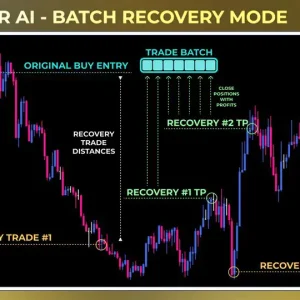

- Risk Management: Only one order is placed at a time, each with a stop loss in place. On average, there are approximately 4 orders per day, each lasting about 12 hours. This approach mitigates risks and safeguards investments.

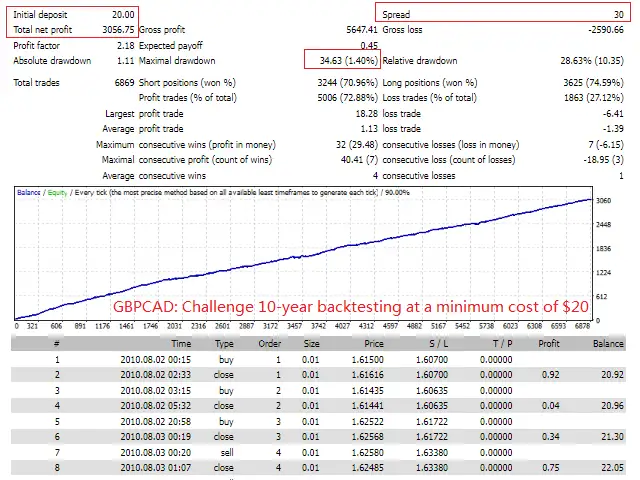

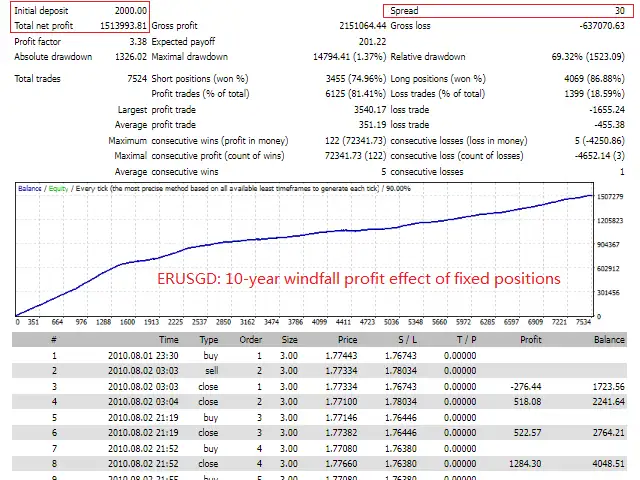

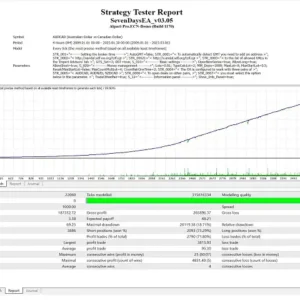

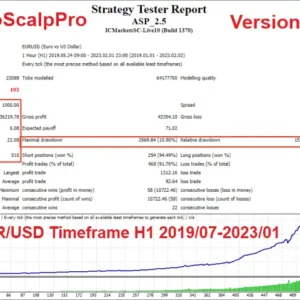

- Backtesting Validation: TopBottomEA has undergone rigorous backtesting for over 10 years, using real historical data from Dukascopy, with a maximum capital of $20. This extensive testing ensures reliability and robustness.

- Real Account Performance: Despite interruptions during the COVID-19 pandemic and server issues, TopBottomEA has maintained its quality, as evidenced by its real account performance, with a reliability rating of 5 grids.

Supported Features:

- Currency Support: TopBottomEA currently supports trading in GBPCAD, EURSGD, GBPCHF, with plans to include additional currency pairs in the future. Emphasis is placed on quality over quantity to ensure stable income generation.

- Chart Period: TopBottomEA operates optimally on the M1 chart period, providing traders with precise and timely insights into market movements.

- Platform Recommendations: Recommended platforms include icmarkets platform original spread account, fpmarkets platform original spread account, and exness platform zero point account. icmarkets is particularly preferred for easy comparison with real observation account transaction records.

Position and Usage Recommendations:

- Position Sizing: Depending on risk tolerance, position sizing recommendations vary. For those sensitive to retracements, a position of 1,000 should be held with 0.03 lots for each of the three currencies. For others, 0.05 lots per currency are recommended.

- Instructions for Use: TopBottomEA should be loaded into GBPCAD, EURSGD, and GBPCHF respectively, on the 1M chart. No parameter adjustments are necessary, except for lot size based on position recommendations.

Risk Management and Mindset:

- Risk Warning: Adherence to recommended settings is crucial to mitigate risks. Any deviation from these recommendations is done at the trader’s own risk.

- Mental Preparedness: Successful EA usage requires a disciplined and patient approach. Traders are reminded to maintain a long-term perspective and resist the temptation of quick profits. Consistency and adherence to sound investment principles are key to sustained success.

Parameter Introduction:

- Lots: Number of lots traded

- Compound Interest Switch: Toggle for compound interest functionality

- Risk: Position value for compound interest, with higher values indicating larger positions

- Parameter Switching: Toggle between automatic and adjustable parameters

- Volatility: Parameter controlling order size based on market volatility

- Stop Loss: Setting for stop loss parameters

- Profit: Setting for take profit parameters

- Point Difference Limit: Spread parameter for platform compatibility

- Display Switch: Toggle for data panel visibility

- Magic: Identification number for orders

- Comment Name: Customizable parameter for order identification

By adhering to these guidelines and utilizing TopBottomEA with diligence and discipline, traders can potentially achieve consistent and profitable trading outcomes.

Reviews

There are no reviews yet.