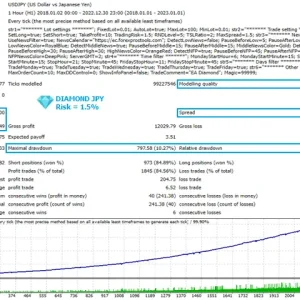

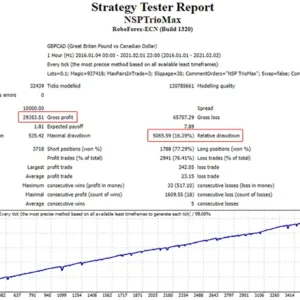

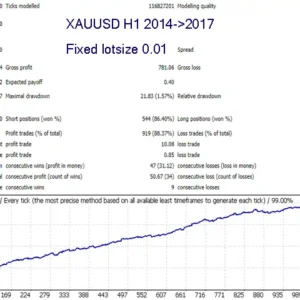

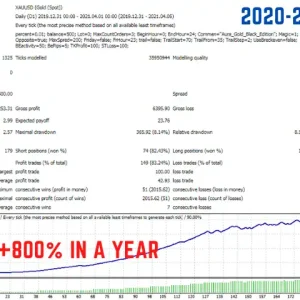

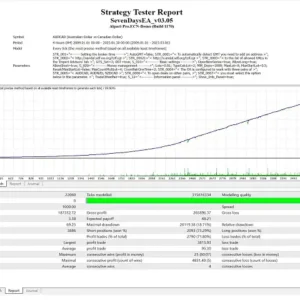

Introducing R Factor, a Multi Strategy Expert Advisor boasting a Proprietary Dynamic Portfolio Management System. Developed over 4 years and backed by over 3 years of consistent positive results, R Factor is now available for the MQL5 community. Our commitment to Skin In The Game ensures that strategies are rigorously tested and proven successful before sharing, fostering trust and continual improvement.

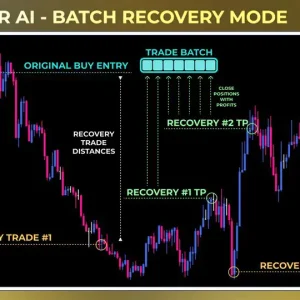

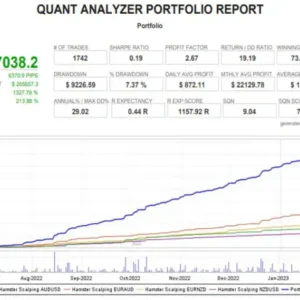

In the volatile market landscape, encountering challenging periods is inevitable. R Factor addresses this by offering multiple strategies for night scalping and breakout trades, complemented by a proprietary dynamic portfolio balancing algorithm. Inspired by Kelly Criterion management, this algorithm adjusts weights within the portfolio, empowering winning pairs while mitigating losses from underperforming ones.

Our algorithm enables winning pairs to gain prominence within the portfolio, amplifying potential gains while minimizing the impact of losses. While this approach may heighten portfolio volatility, the potential for increased profits outweighs the risks, offering a favorable equation for investors seeking greater returns.

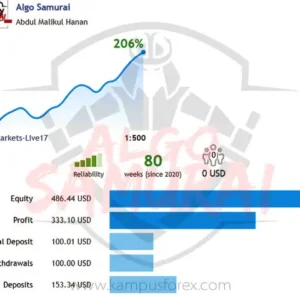

Explore real account performance signals showcasing various R Factor sets and strategies, some with over 3 years of recorded success. While past performance doesn’t guarantee future results, it serves as a positive indicator of adaptability to market changes.

For optimal performance, we recommend utilizing brokers with low spreads and fair commissions. Check our provided link for the best brokers available.

Live signals

- 6 Years Track Record

- MR Strategy portfolio

- JM Strategy portfolio

- Agressive

- Very Agressive

- Exotic Pair

- EURCAD High Risk

- Sonic W Recovery Strategy

- 1 Hour Strategy

- Last 15 Strategy

- Custom Strategy

- Weekend Trading 22 L Aggressive Strategy

- Neural Network Strategy

MAM ACCOUNTS

And here we have recent live performances in 20 Different Brokers! Check it here.

Key Characteristics of R Factor Strategies:

- Single Chart Setup

- Defined Stop Loss and Dynamic Take Profit

- One trade per pair at a time, excluding Averaging or Martingale methods

- Intelligent Trade Exit System

- News Filter Integration

- Over 3 years of live-proven algorithm performance

- Proprietary Backtest Simulation for High Spread periods

- Low starting capital requirement (starting at $30 USD for one pair or $100 USD for a complete portfolio with 12 pairs)

Reviews

There are no reviews yet.