Intelligent Algorithm CEF Silicon Falcon for Forex Trading

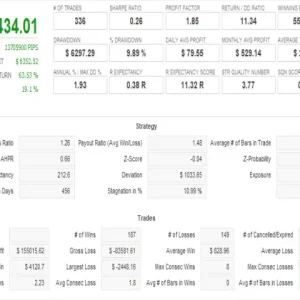

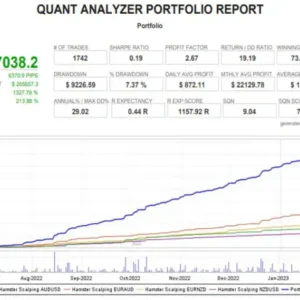

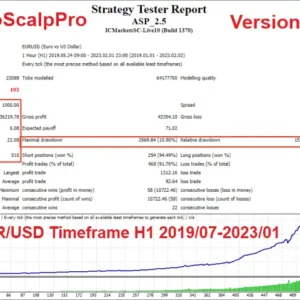

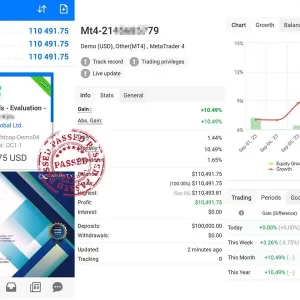

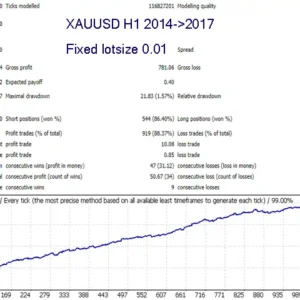

The intelligent algorithm CEF Silicon Falcon continuously adapts to the ever-changing market, making it a powerful tool for Forex trading. To back-test, choose the EURUSD 1-hour time-frame using the current spread in every tick mode, and run the test. This system is an exact clone of a system developed for a hedge fund under contract in Node.js. Identical systems are used in big banks and proprietary trading firms on Wall Street.

Primary Operation:

Designed for EURUSD H1, but additional settings are possible on other currency pairs.

User Variables:

- Use Money Management: Enables automatic lot sizing.

- MM Risk Setting: Risk setting used if money management is enabled.

- Lot Size: Fixed lot size if money management is disabled.

- Period for S/R Algo: Time frame for the entry algorithm.

- Channel Period: Length of the initial price channel.

- Bars After Signal Bar: Number of bars after high/low in the analyzed channel.

- Look Back Period: How far into the past to scan for scalping channels.

- Max Pending Orders: Maximum number of pending orders.

- Min Trade Spacing: Minimum pips between entry orders or past positions.

- Buy Order Offset: Amount above channel high to place pending entry orders.

- Sell Order Offset: Amount below channel low to place pending entry orders.

- Min Dist New Orders: Minimum distance from current bid/ask for new entry orders.

- Target Profit: Target profit in pips.

- Stop Loss: Stop loss in pips.

- Trailing Stop: Trailing stop in pips.

- Trail Step: Trail step in pips.

- Break Even Activation Pips: Price must reach this far into profit for breakeven activation.

- Pips to Lock In: Pips to lock in with breakeven activation.

- Time Choice: Choose between GMT, Broker (trade server), or Local (PC/VPS) time.

- Use Trading Hours: Set to true to use trading hours.

- Close Trades Outside Hours: Close open positions outside of trading hours.

- Hour to Start Trading: Hour to start trading (using broker time).

- Hour To Stop Trading: Hour to stop trading (using broker time).

- Friday Exit Hour: Hour to stop trading on Friday and delete pending entry orders.

- Close Trades On Friday: Close open positions after Friday close.

- Use Rollover Protection: Set true to activate rollover protection, taking action 5 minutes before and after broker rollover time to protect the account.

- Rollover Hour: Hour of rollover (22 if using GMT hours and broker is GMT +2; 0 if using broker hours).

- Rollover Order Distance: Distance within which rollover protection will delete entry orders to prevent them from being filled with a huge spread.

- Rollover Widen SL Pips: Amount to widen stop loss of open positions during rollover. Normal size SL will be replaced immediately after rollover.

- Sunday – Friday: Choose to trade or skip (True or False).

- Trade NFP Friday: True or False.

- Trade Thursday Before NFP: True or False.

- Trade Christmas Break: True or False.

- Day To Begin Break: Day to begin break (e.g., 15 for 15th December).

- Trade New Year Holiday: True or False.

- Day To Return After Break: Day to return after break (e.g., 3 for 3rd January).

- Transparent Display: Set true to see through on chart display.

- Trade Comment: Comment to be sent with trades.

- Max Spread: Maximum spread allowed for entry orders and before orders are deleted for safety.

- Distance To Cancel: Distance in pips within which orders will be deleted if the maximum spread is exceeded.

- Max 1 Min Spike Size: Maximum spike size allowed on the 1-minute time frame. Orders will be deleted for safety if exceeded.

- Time Out: Timeout duration after a big spike or spread.

- FIFO Friendly: Enable for FIFO brokers.

- Magic Number: Use a unique number for each strategy on any additional instance of Apex running on the same account and currency pair.

By utilizing the CEF Silicon Falcon, traders can benefit from a sophisticated, automated trading system designed for optimal performance and risk management in the Forex market.

Reviews

There are no reviews yet.