Boring Pips EA

Are you puzzled by the inefficacy of most expert advisors in live trading, despite their flawless backtest performance? The probable culprit: Over-fitting. Many EAs are engineered to learn and adapt meticulously to historical data, yet falter in predicting the future due to a lack of model generalizability.

Some developers remain oblivious to over-fitting, while others exploit it to embellish backtest results by inundating the strategy with numerous input parameters, without regard for statistical significance. They endeavor to persuade others that their EA can replicate past performance in the future.

For those intrigued by this subject, seeking deeper insight into over-fitting, refer to my articles:

Avoiding Over-fitting in Trading Strategy (Part 1): Identifying Signs and Causes

Avoiding Over-fitting in Trading Strategy (Part 2): A Guide to Building Optimization Processes

There are several strategies to prevent losses on an expert advisor reliant solely on past data. The simplest: NEVER UTILIZE AN EA WITHOUT LIVE TRADING RESULTS FOR A MINIMUM OF 5 MONTHS OR 300 TRACKED TRADES, REGARDLESS OF ITS COST OR BACKTEST RESULTS. Monitoring live trades is the surest way to gauge an EA’s performance with unseen data.

Boring Pips optimization process – A meticulous validation process that makes a difference.

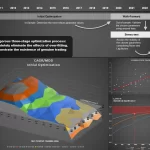

Boring Pips undergoes a thorough optimization process called Anti-overfitting, designed to eradicate over-fitting’s influence on the trading system, ensuring the model’s generality. Refer to the linked article in Part 2 above for a detailed look at this process.

The Anti-overfitting process comprises 3 stages:

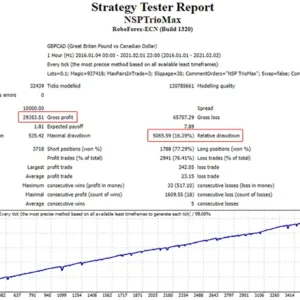

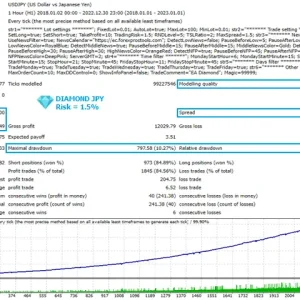

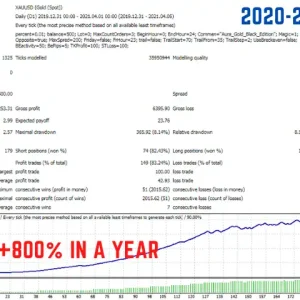

- Initial Optimization: Optimize Boring Pips using historical data from 2010 to 2019, testing the initial trading strategy premise and extracting robust parameter values.

- Walk-forward: Test parameters that performed well in the initial stage with entirely new data from 2019 to 2022, ensuring trading system stability and evaluating model predictive power.

- Stress Testing: Subject parameter values passing the first two stages to Stress Testing. This final test introduces variables like Noise and Lag to entry and exit points, pushing the system beyond its ‘comfort zone’ to assess tolerance to random factors.

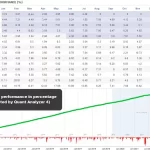

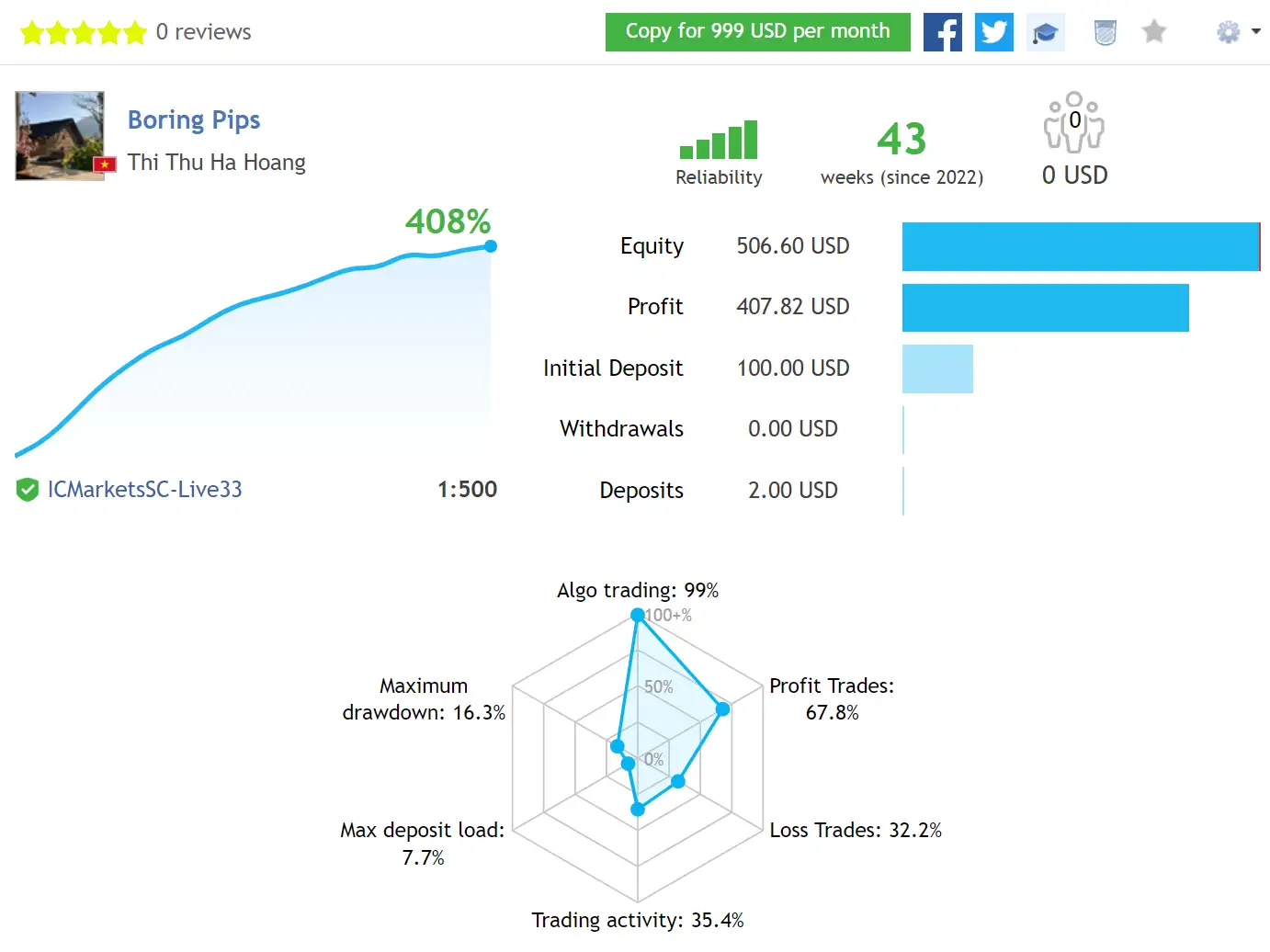

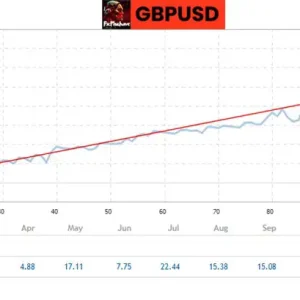

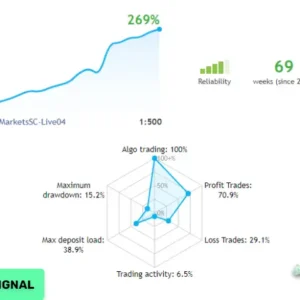

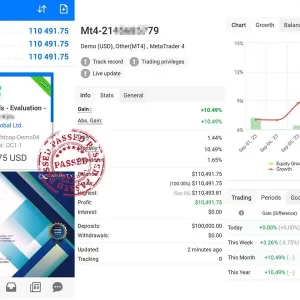

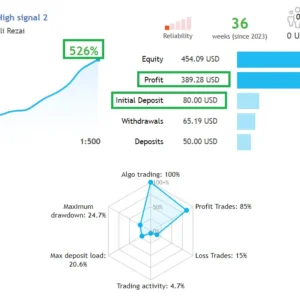

Live Trading Monitoring: Robust parameter values extracted from the Anti-overfitting process have been tested for trading performance with a real account since October 10, 2022. Track the account via the link provided.

Introduction to algorithm:

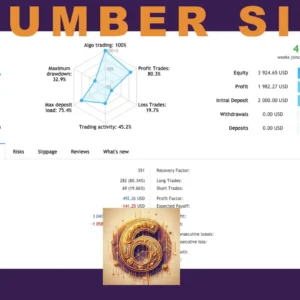

Boring Pips blends cutting-edge AI algorithms with classic trading strategies like momentum, supply-demand zones, and Fibonacci retracement. Using an advanced formula based on deep learning algorithms, it simultaneously measures price momentum across 4 time frames, enabling informed trading decisions.

Features:

- Name: Boring Pips

- Version: 3.20

- Platform: MT4, MT5

- Trading Strategies: Momentum, Supply and Demand zones, Fibonacci retracement, Artificial intelligence

- Recommended Pairs: AUDNZD, NZDCAD, AUDCAD

- Time-frame: M5

- MultiCurrency EA: Yes. One chart for all symbols

- Take Profit: Yes. Trailing

- Stop Loss: Yes. Fixed

- Grid: Optional

- Martingale: Optional

- Manual Risk Management: Yes. Stop entering/Close all positions

Recommended Installation:

Follow detailed instructions for installing Boring Pips on one of the specified charts, selecting trading symbols, risk mode, base balance, personalization settings, and risk management settings.

For backtesting, use high-quality data from third-party tick providers.

Reviews

There are no reviews yet.