Introducing Bitcoin Scalp Pro, a cutting-edge trading system designed to capitalize on the dynamic nature of the Bitcoin market. Our strategy revolves around identifying and leveraging breakout opportunities at key support and resistance levels. With a steadfast commitment to safety, Bitcoin Scalp Pro boasts remarkably low drawdowns and an exceptional risk/reward ratio for every trade.

At the core of our system is a sophisticated “smart adaptive parameter system” that dynamically adjusts stop loss, take profit, trailing stop loss, as well as entry points and lot sizes based on real-time Bitcoin prices. Whether Bitcoin is trading at 6000 or 30000, our system recalibrates all parameters accordingly.

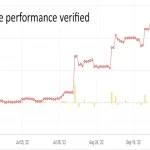

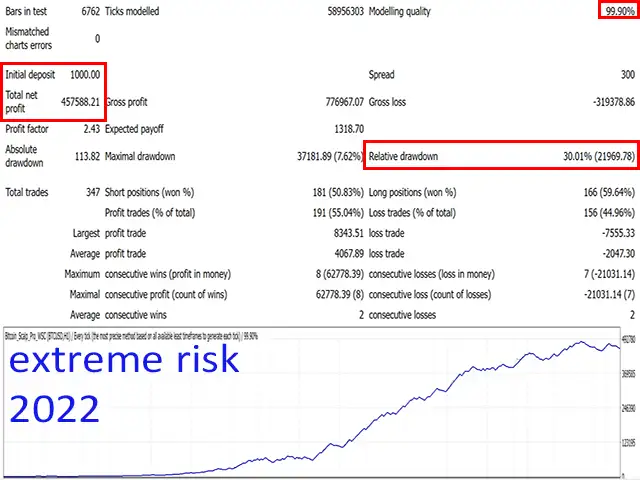

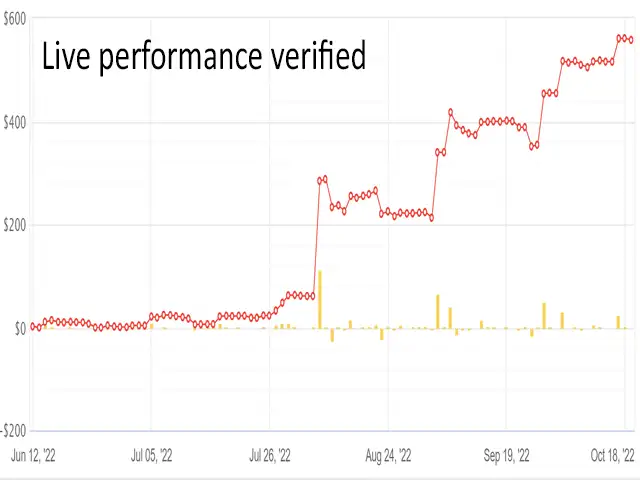

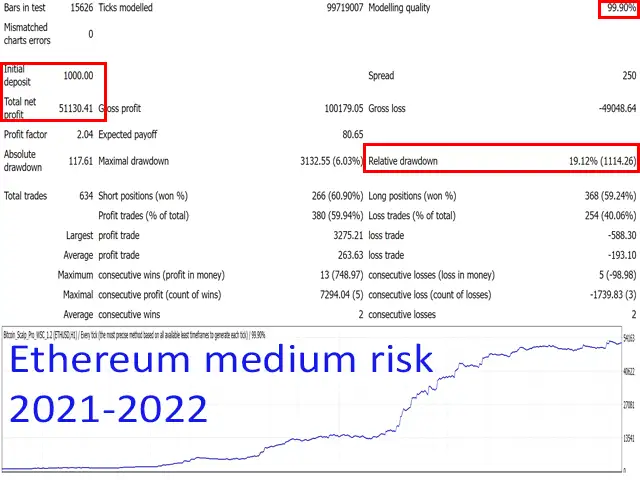

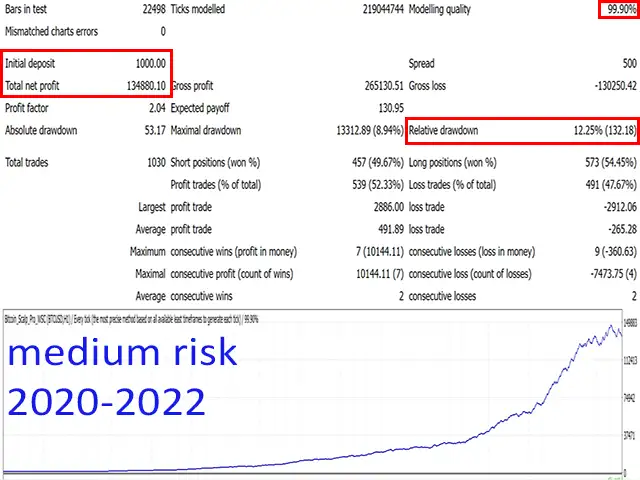

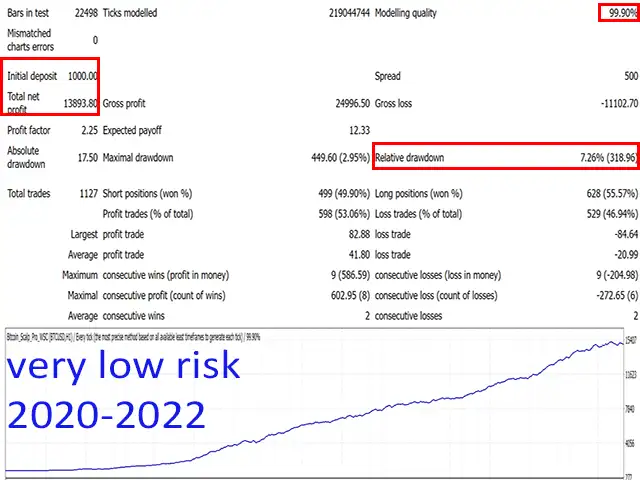

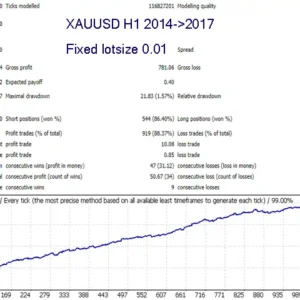

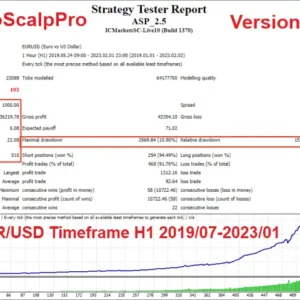

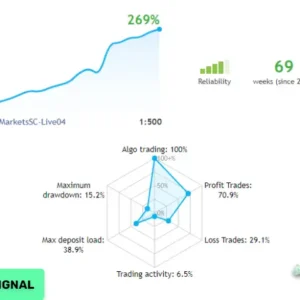

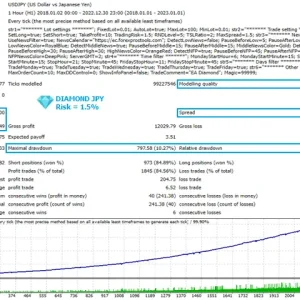

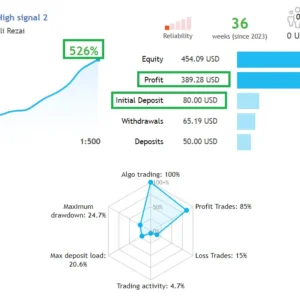

Having undergone rigorous forward testing on live accounts since June 2022, Bitcoin Scalp Pro has demonstrated highly promising results. Furthermore, extensive backtesting, conducted with 99.90% tick quality, has consistently showcased stable growth over recent years.

To utilize Bitcoin Scalp Pro effectively, it’s imperative to partner with a broker offering low spreads on Bitcoin. Excitingly, our system now extends its support to Ethereum as well!

Key Features:

- Adaptive parameter system adjusts SL, TP, entries, and lot size based on real-time Bitcoin prices

- Exceptional risk/reward ratio of 2 to 1

- Verified live trading results

- Automatic lot size calculation based on risk and price

- Safe trading with SL and Trailing SL on all trades

- No grid, Martingale, or risky trade management systems

- Minimum deposit: $200

Setting up the EA:

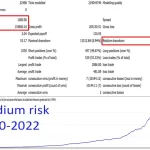

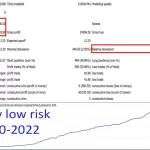

Setting up is effortless: simply open an H1 chart and run the EA. Customize your preferred risk level using the “Lotsize Calculation Method” parameter. We offer predefined risk settings ranging from 0.5% Risk Per Trade (very low risk) to 10% Risk Per Trade (extreme risk). It’s advisable to start with a conservative risk level and adjust as you become more acquainted with the EA’s trading behavior. While our parameters are intuitive, don’t hesitate to reach out if you need further clarification.

Backtesting the EA:

For accurate backtesting, select a reliable historical price feed with low spreads, or manually set spreads. Spreads should ideally average below 1000 points for optimal results.

Reviews

There are no reviews yet.