ADAPT EA: Revolutionary Forex Trading Robot with Adaptive Grid Strategy

Overview

ADAPT EA introduces a groundbreaking approach to the Forex market, leveraging adaptive algorithms to adjust to the ever-changing market dynamics. Unlike traditional grid strategies, ADAPT EA combines advanced adaptability with proven techniques to ensure high profitability and reliability.

Key Features

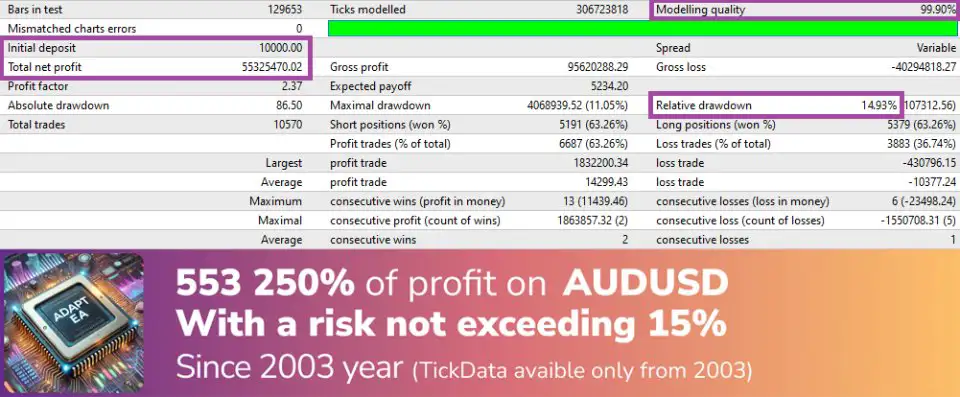

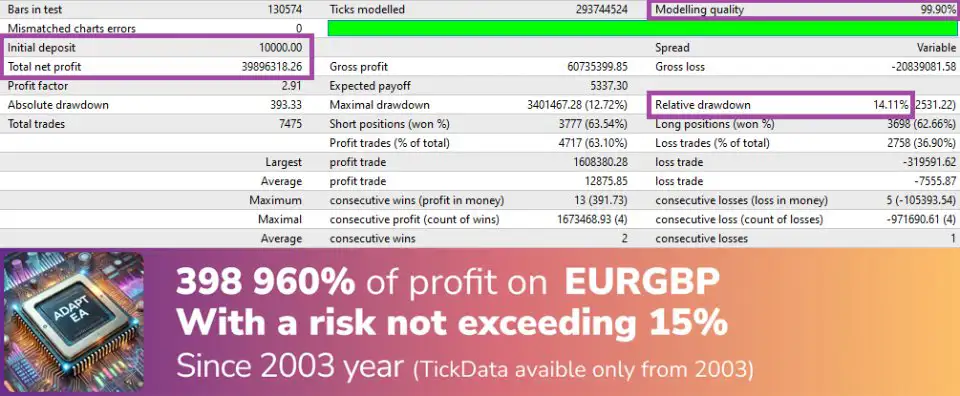

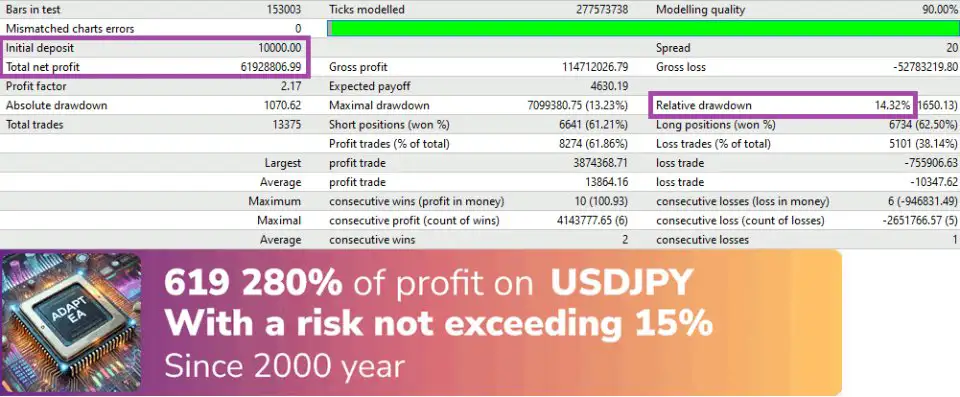

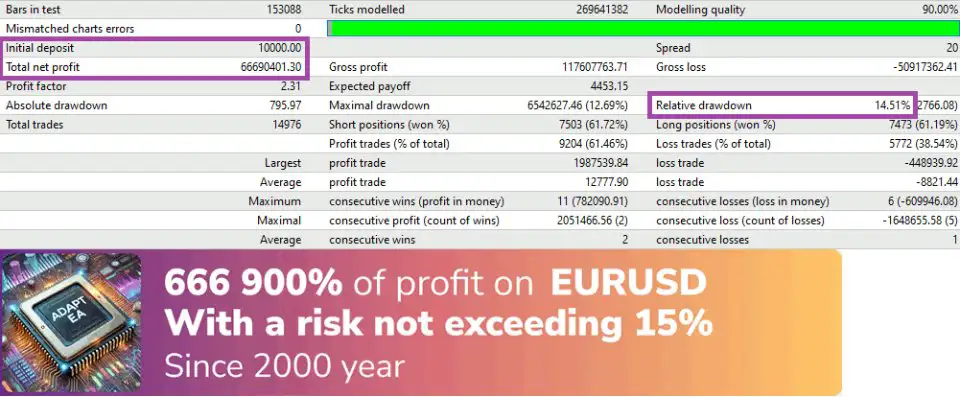

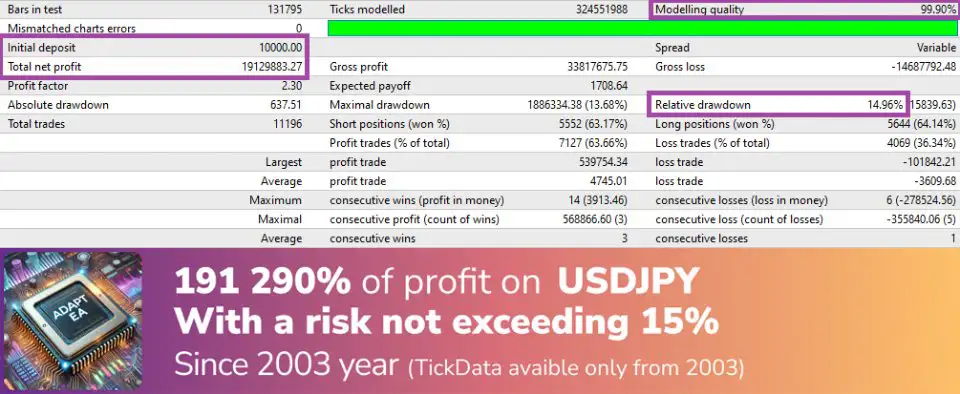

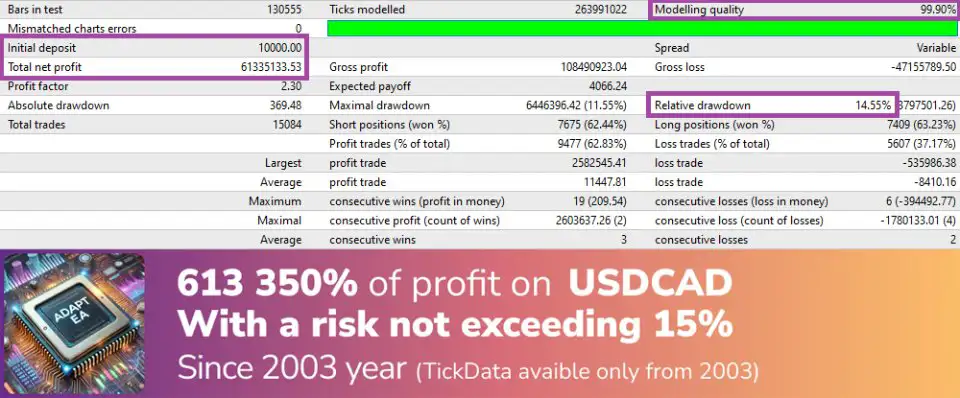

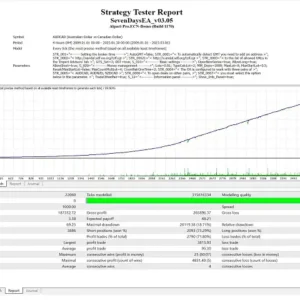

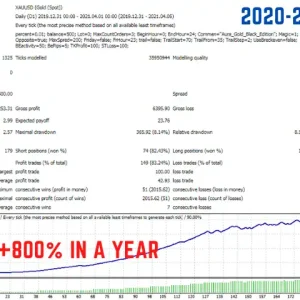

- 24 Years of Backtesting Excellence: Proven performance since 2000.

- High Profitability: Adaptive algorithms optimize returns.

- Universal Broker Compatibility: Works seamlessly with any broker.

- Robust Drawdown Control: Advanced systems to manage and mitigate risks.

- Supported Currency Pairs: USDCAD, EURUSD, AUDUSD, EURGBP, USDJPY.

Download Resources

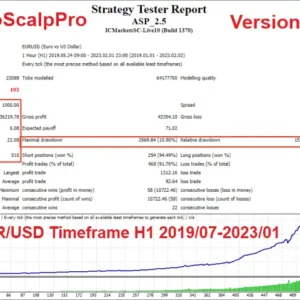

– Standard Backtests (EveryTick)

– 99% TickData Backtest (Ducascopy)

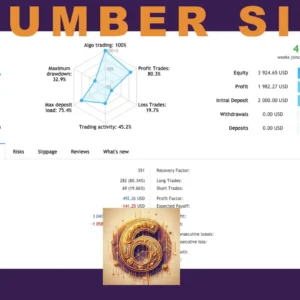

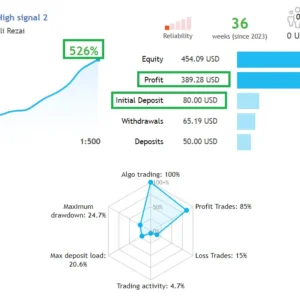

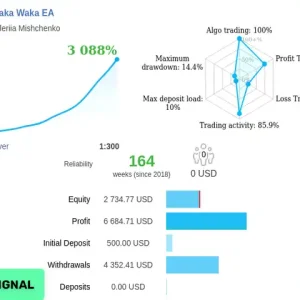

– Live Account (Aggressive Mode)

About Our Development Team

With over 15 years of expertise in developing Forex Expert Advisors, our professional team is committed to excellence. We rigorously test each robot, ensuring only the most reliable and profitable ones reach our clients. This meticulous approach guarantees top-tier performance and customer satisfaction.

The Three Pillars of ADAPT EA

- Grid Strategy

- Overview: Utilizes a robust grid strategy that capitalizes on market retracements.

- Challenges Addressed: Overcomes traditional grid strategy limitations by integrating adaptive mechanisms.

- Adaptive Settings

- Dynamic Adjustments: Continuously fine-tunes grid parameters based on current market conditions.

- Enhanced Reliability: Ensures necessary margins are always available for optimal strategy execution.

- Adaptive Money Management (MM) Parameters

- Market-Driven MM: Selects optimal money management strategies aligned with prevailing market conditions.

- Resilience: Ensures robust performance across diverse market scenarios.

Outstanding Features

- User-Friendly Configuration: Simply specify the percentage of your deposit you wish to trade; ADAPT EA handles the rest.

- Consistent Drawdown Management: Maintains drawdown limits (Stop Loss) at user-specified levels.

- High Profitability: Adaptive approach ensures exceptional returns.

- Broker Flexibility: Compatible with all Forex brokers; no special conditions required.

- Automated Risk Management: Features automatic drawdown control and lot size calculations based on user-defined risk parameters.

- Multi-Currency Support: Optimized for trading with five major currency pairs.

Customization and Flexibility

While ADAPT EA’s complexity prevents the provision of all configuration parameters for optimization, users have the option to manually adjust certain settings. This flexibility allows the robot to operate effectively with any currency pair.

Recommendations

- Minimum Recommended Deposit for 0.01 Lot Size:

- Risk 100%:

- USDCAD: $1,070

- EURUSD: $1,300

- AUDUSD: $750

- EURGBP: $700

- USDJPY: $830

- Risk 20%:

- USDCAD: $5,350

- EURUSD: $6,500

- AUDUSD: $3,750

- EURGBP: $3,500

- USDJPY: $4,150

- User Guide: Download the Detailed User Guide

Backtesting Tips and Recommendations

- Spread Settings:

- Default Behavior: MT4 and MT5 strategy testers default to using the ‘Current’ spread value, which can skew backtest results, especially during weekends.

- Recommendation: Manually set the spread to an average value typical for the currency pair being tested to ensure accurate backtest outcomes.

- Leverage Considerations:

- Understanding Leverage: The strategy tester emulates the leverage of the currently logged-in account.

- Recommendation: For testing ADAPT EA, use the recommended leverage settings or set it to 1:500 to avoid issues arising from low leverage during testing.

Reviews

There are no reviews yet.