A Forex trading robot or Expert Advisor (EA) is a program in the world of forex trading that traders install on their trading platforms to automate trading activities. These robots use computer algorithms based on predefined signals to determine the best price for buying or selling a currency pair. In this article, we will discuss what exactly a Forex trading robot is, what factors to consider when searching for one, and the pros and cons of using a robot in forex trading.

What is a Forex Expert Advisor (EA)?

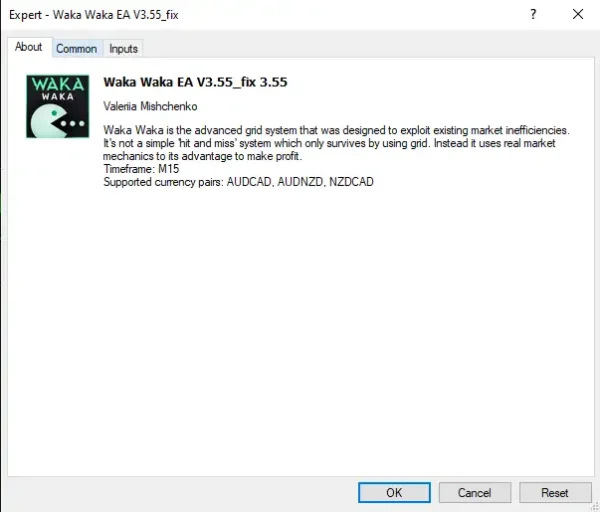

A Forex Expert Advisor, also known as an EA, is a trading program designed to assist traders in generating signals about when to buy or sell a specific currency pair. These programs operate entirely automatically. MetaTrader remains the most widely used trading software for traders, and most EAs are built using the MQL programming language. Over time, a significant number of EAs have been developed for MT4.

One advantage of using a Forex robot is the elimination of the psychological aspects of trading, which often hinder a trader’s performance. While the idea of a computer program telling you when to enter or exit a trade may seem beneficial for your profits, it’s crucial to note that no trading strategy is foolproof, and caution is always necessary.

Who Uses Expert Advisors (EAs)?

EAs are widely used in the forex trading community. Some traders exclusively use EAs and do not execute manual trades, while others may decide to diversify and use EAs alongside manual trading strategies. Whether using EAs is compatible with your personality as a trader depends on your comfort level with decision-making and emotions during trading. If you struggle with decision-making and emotions, using EAs might be valuable.

On the other hand, if having complete control over your trades is essential to you, you may find doubts about the performance of EAs and may not have a good feeling about their long-term use. Using a demo account can be helpful as it allows you to test EAs in a risk-free environment. Beginners often focus on finding the best Forex robots, but no trading system is perfect, and even profitable Forex robots may suddenly become ineffective if market conditions change.

What to Consider When Searching for a Forex Expert Advisor?

In Forex trading, there is no “always winning” system, contrary to discussions about manual or automated trading. When considering automatic trades, the first question a trader should ask is whether they want to develop their own Forex trading robot or purchase one from the market.

If you decide to buy an automated trading system, do not solely rely on the profitability of trades and success rates. Reading user reviews and examining their results on sites like MQL5 can provide a general overview. While it’s essential not to fully trust these sources, the experiences of other traders with a specific EA can be useful.

Additionally, you should conduct your own tests. Many EA providers offer trial versions, and you can use the strategy tester tool within MT4. When analyzing statistics, pay attention to factors such as profit factor, maximum drawdown, and risk-reward ratio.

How to Use Forex Expert Advisors (EAs) for Trading?

Programming languages like MQL4 and MQL5 are used for developing Forex trading robots, custom indicators, and scripts on MT4 and MT5 platforms. These languages are supported by MetaQuotes, and a large community of developers shares their EAs on the MQL5 website.

Steps to Install a Forex Expert Advisor in MetaTrader 4:

1. Download the EA.

2. Copy the EA file.

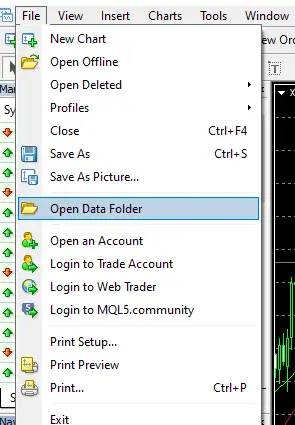

3. Open “MetaTrader 4” and select “Open data folder” from the File menu.

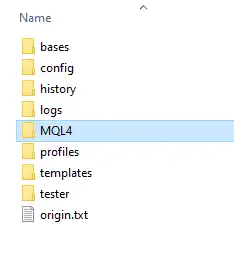

4. Open the MQL4 folder from the window that appears.

5. Paste the file into the “experts” folder.

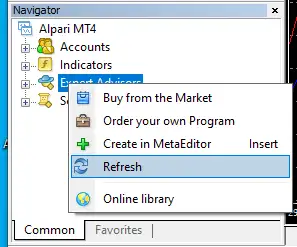

6. Find the ‘Navigator’ window on the left side of the platform, right-click on ‘Expert Advisor,’ and choose ‘Refresh’ to see the copied EA.

7. In the ‘Navigator’ window, find ‘Expert Advisor,’ click the plus sign (+), and see the copied EA.

8. Double-click on the EA’s name or drag it onto the chart to open the settings window.

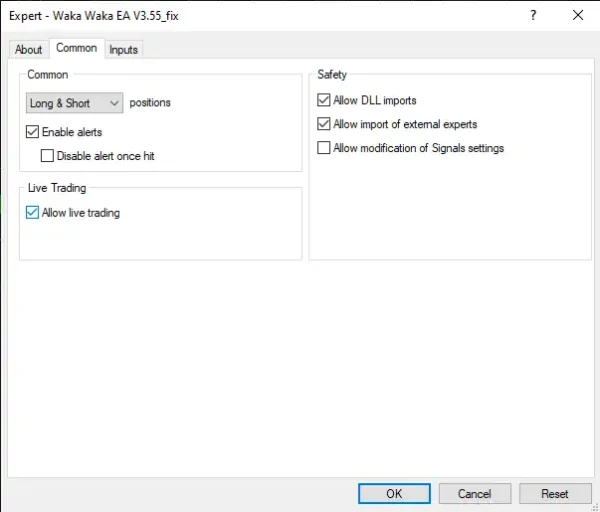

9. In the settings window, go to the ‘Common’ tab, enable ‘Allow live trading’ in the ‘Live Trading’ section.

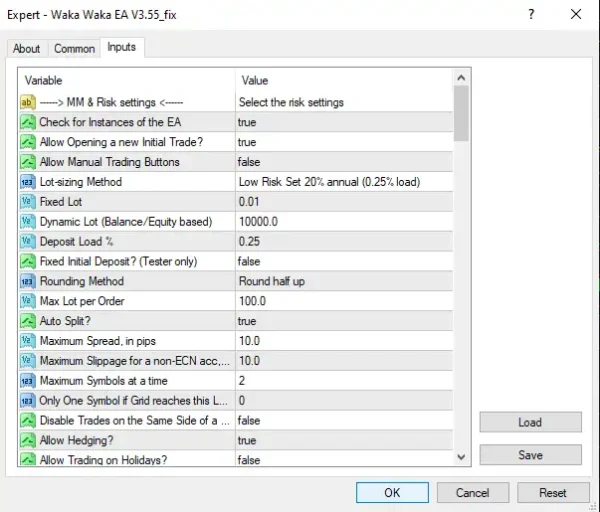

10. Go to the ‘Inputs’ tab to modify default EA settings if needed. Load or save settings if applicable.

11. Click ‘OK’ after completing the settings to activate the EA.

Using EAs involves careful consideration, testing, and continuous monitoring. Always be cautious and understand that past performance does not guarantee future results in the dynamic forex market.

Advantages of Using Forex Robots in Trading

Discover the advantages of using Forex robots in your trading program:

1. Time: A full-time trader requires a significant amount of time and patience, limiting their ability to track multiple currency pairs or indices. However, trading robots allow you to execute trades on an infinite number of currency pairs and various indices full-time. This frees up your time, enabling you to dedicate more time to learning, maintaining a trading journal, and expanding your trading skills.

2. Emotions: Trading robots clearly follow instructions, making it easier for traders who struggle with emotional management to execute trades. Nevertheless, discipline is still required as losses will inevitably occur, and additional calmness is needed.

3. Integration with Your Strategy: Some manual traders may decide to use EAs to diversify their strategies. For example, a long-term trader exclusively trading indices may use short-term EA strategies that trade currencies to complement their predictions. For instance, if anticipating a decline in the value of the dollar, an EA could be set to sell EURUSD short-term, generating profits.

Disadvantages of Using Forex Robots in Trading

Having covered the advantages, let’s now review some of the disadvantages of using a Forex Expert Advisor (EA) in trading:

1. Technical Issues: To prevent technical problems such as internet or power outages, it is advisable to use a Virtual Private Server (VPS). Choosing a broker is also crucial, as most EAs are sensitive to brokers’ spread and slippage, impacting their performance. You can use our recommended VPS list and broker list for a reliable selection.

2. Negative Impact of News: Robots follow rules and cannot detect changes in market sentiment or how a news announcement may impact the market. To address this issue, you can pause the EA during news announcements and activate it after market calmness is restored.

3. Importance of Good Backtesting over Long-Term Periods: Some EAs available in the market may not perform well in specific market conditions. As a trader, you can identify periods of loss with long-term backtesting, recognizing potential losses, and preventing them by stopping the EA during similar market conditions. For instance, one EA may not work well in a ranging market, while another excels, allowing you to combine both for optimal market utilization. This requires good backtesting of EAs and your experience.

Conclusion

Forex trading robots (EAs) are advancing day by day, allowing even users with minimal knowledge of economics and trading to benefit from these tools across different time frames. Considering the advantages of trading robots and continuous advancements in data analysis and artificial intelligence, algorithmic trading is shaping the future of global trading and the economy.

If you are actively engaged in the forex market but have yet to achieve your desired profits, ShopEA provides an opportunity for success by offering the best market EAs at the lowest possible prices. Visit our store page to explore products and experience profitable trading with minimal costs.